In today's digital era, technology is revolutionizing medical insurance, offering Best Medical Insurance Plans. Online platforms empower policyholders with easy access to records, claim management, and virtual consultations. Digitalization streamlines processes for both insurers and insured, enables precise risk assessment using advanced analytics, and facilitates personalized pricing based on real-world data. Cutting-edge tech, combined with tailored policies, enhances healthcare experiences, makes coverage more accessible, and simplifies administration, particularly through telemedicine, health data analysis, and user-friendly digital platforms.

In today’s digital era, the landscape of medical insurance is undergoing a significant transformation. The role of technology in shaping best medical insurance plans has been pivotal, enhancing accessibility and improving customer experiences. This article explores this shift towards digitalization, delving into how cutting-edge technologies are reshaping modern medical insurance. We’ll uncover the impact on plan design and delivery, highlighting best practices for creating comprehensive, tech-integrated coverage that meets the needs of today’s folks.

- Understanding Modern Medical Insurance: A Shift Towards Digitalization

- The Impact of Technology on Insurance Plans and Customer Experience

- Best Practices: Creating Comprehensive Medical Insurance with Tech Integration

Understanding Modern Medical Insurance: A Shift Towards Digitalization

In today’s digital era, understanding modern medical insurance plans has undergone a significant shift towards digitalization. The best medical insurance plans now leverage technology to enhance accessibility, transparency, and efficiency. Online platforms allow policyholders to easily manage their claims, track healthcare expenses, and even consult with providers virtually. This marks a departure from traditional paper-based processes, making it more convenient for both insurers and insured individuals.

Digitalization also facilitates better risk assessment and pricing strategies. By analyzing vast datasets through advanced analytics, insurance companies can tailor policies to individual needs more accurately. This means that best medical insurance plans are becoming increasingly personalized, offering comprehensive coverage tailored to specific health conditions or lifestyles. Such innovations not only improve customer satisfaction but also ensure fairer pricing models based on real-world data insights.

The Impact of Technology on Insurance Plans and Customer Experience

In today’s digital era, technology is revolutionizing the landscape of medical insurance plans, transforming how customers interact with their coverage options. The best medical insurance plans now leverage advanced tools and platforms to enhance customer experiences. Online portals and mobile apps enable policyholders to easily manage their accounts, track claims, and access important health information at their fingertips. This accessibility not only improves convenience but also empowers individuals to take a more active role in their healthcare decisions.

Moreover, technology has enabled insurers to offer personalized coverage options tailored to individual needs. Using data analytics and artificial intelligence, insurance companies can analyze customer health records, lifestyles, and risk factors to design customized plans. This approach ensures that best medical insurance plans meet the unique requirements of each policyholder, providing comprehensive protection while optimizing costs.

Best Practices: Creating Comprehensive Medical Insurance with Tech Integration

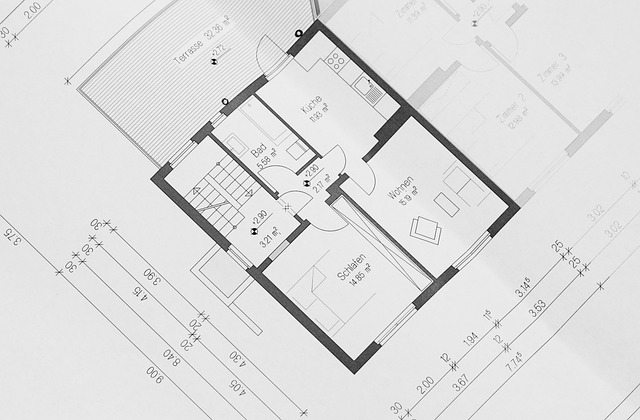

In the quest for optimal healthcare coverage, the integration of technology into medical insurance plans emerges as a game-changer. The best medical insurance providers are those that seamlessly blend cutting-edge tech with comprehensive policy designs. This approach ensures that every aspect of an individual’s healthcare journey is meticulously managed and optimized. For instance, digital platforms enable policyholders to access their records, schedule appointments, and file claims efficiently.

Furthermore, technology facilitates personalized coverage by analyzing vast health data sets, leading to tailored policies. Telemedicine, another tech-driven trend, expands access to medical services, especially in remote areas, thereby improving overall healthcare accessibility and quality. By embracing these best practices, insurers can create best medical insurance plans that not only safeguard individuals’ health but also simplify the often complex world of healthcare administration.

In a rapidly evolving digital landscape, technology plays a pivotal role in enhancing modern medical insurance plans. By leveraging innovative solutions, insurance providers can offer more comprehensive coverage, improved customer experiences, and streamlined processes. Integrating tech into best medical insurance plans not only simplifies claims management but also enables proactive health monitoring and personalized care. As the world of healthcare advances, embracing these technological advancements is essential to meet the evolving needs of policyholders and ensure they receive the best possible care.